5 Signs of Digital Disruption in Insurance

5 Signs of Digital Disruption in Insurance

What is a digital disruption in insurance? What are the signs of the upcoming digital disruption in the insurance sector? What changes are inevitable?

About the disrupting insurance sector

The insurance industry faces new challenges like many other sectors: old software programs have to be renewed, the bureaucracy has to be reduced. Despite the constant improvement in digital solutions, insurance technology is considered to be old-fashioned. Lots of paperwork, inflexible health care, and life insurance plans are the features of this sector.

The goal is clear: using modern technology we need to rethink and reorganize the insurance industry and follow its trends.

5 signs of digital disruption in insurance

Most innovative insurance companies already solving the above-mentioned problems. They are creating user-friendly flows, widely available services, and new wearable products that are making it easier to take out insurance.

New technologies, products, and services

At the age of smartphones and smartwatches, it’s required to have a mobile app that can track your activity. For example:

- A newly developed car can track your fuel consumption and even your driving style. It can tell that you shift too soon or too late, or if your braking distances are too short.

- A wearable device can measure your heart rate and blood pressure, analyzing the risks if you are having some disease or not.

New technologies and products are helping the insurance industry to collect any necessary data.

And analyzing the data will lead to new, customizable services.

Big Data Analytics

Using real-time data improves the quality of services. Of course, customer privacy and data protection have to be provided for the users. Blockchain technology can help to transfer data privately.

Big Data can help insurance companies to find patterns and optimize their plans.

AI

Artificial intelligence is a key element in the insurance market. Based on the real-time data, it can offer customized plans for the users. Sticking with the above-mentioned example: if someone is living with unhealthy habits, thus the measured blood pressure isn’t appropriate, the risks are higher to develop a disease. Therefore, using risk management the AI software will choose a more expensive plan for the user than it would choose for a healthily living person or recommend science-based lifestyle interventions on how to maintain a normal blood pressure in order to minimize risks of serious cardiovascular events.

Customer-centric decision making

The digital customer experience is essential in today’s services. An interface has to be simple and understandable for every generation, and easy to use. The registration process needs to be quick. The best example is the travel industry: if someone is traveling to a destination and needs quick accident insurance for tomorrow, then the insurance has to be provided immediately.

AI can help in customer satisfaction too: it can learn from the users’ questions and answer these after it learned them.

New insurance companies join the competition

As time passes, people recognize new areas of use for insurance. New business models emerge to solve new problems, for example

- companies specialized for COVID-cases: now you can take insurance even for event-canceling

The increased competition is not only about improving the existing services but to create new ones.

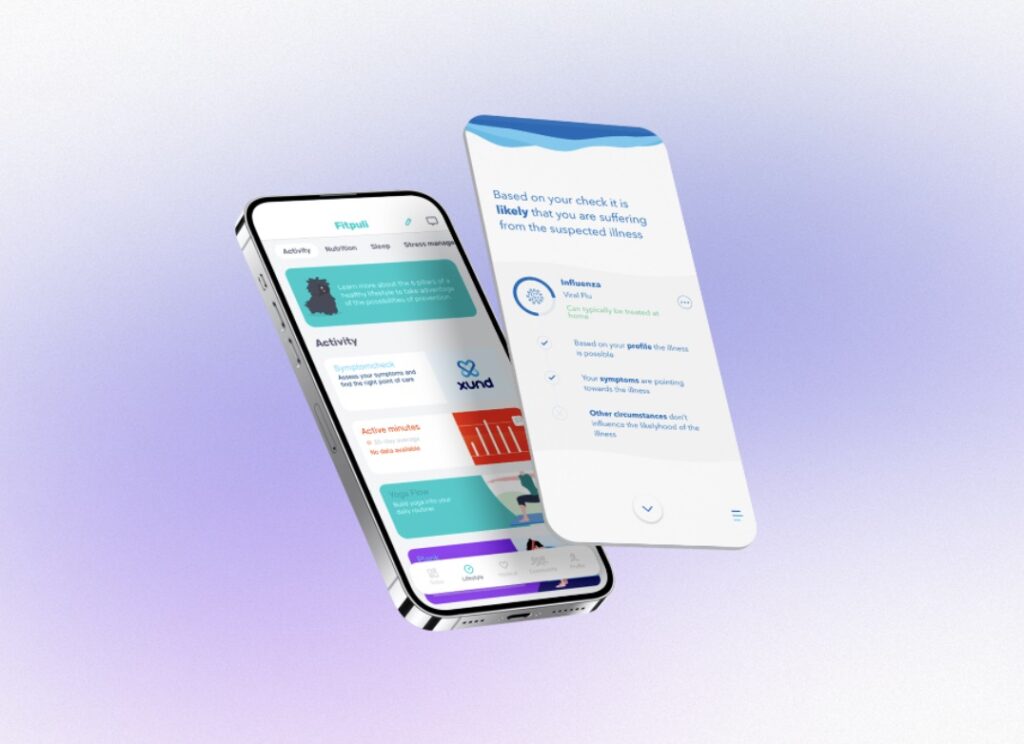

Fitpuli’s features in health insurance

Fitpuli provides health insurance technology that is useful for any corporation. In our subscription plans, you can have

- Fitpuli application

- Professional attitude test

- Team challenges

- Occupational health services, such as telemedicine

- Health insurance

24/7 available doctor appointments, health insurance, and preventive approach come with Fitpuli. Maintain a better workplace environment and enforce your colleagues to raise productivity!

Summary: insurance disruption

Traditional insurance is almost broken, as most of the companies (sooner or later) started to follow the new insurance industry trends.

The basics are:

- No more paperwork

- No human interaction necessary

- Taking out insurance needs to be quick and simple

- Personalized plans have to be provided

Try our health care program! Check out our subscriptions.

Based entirely on scientific evidence, our digital employee wellness programme has been created for companies looking to win big.

Puli Start

Fitpuli

Improve employee health awareness and productivity, cut illness-related costs

- Fitpuli application

- Team challenges

- Professional attitude test

Puli Plus

Fitpuli + Occupational health

(Currently only available in Hungary)

Combine our digital wellness programme with occupational health services for efficient prevention and increased savings

- Fitpuli application

- Professional attitude test

- Occupational health services

Puli Care

Fitpuli + Insurance

(Currently only available in Hungary)

Improve employee health awareness and cut illness-related costs by offering company health insurance plans and first-class healthcare to your employees.

- Fitpuli application

- Professional attitude test

- Health insurance

Puli Pro

Fitpuli + Occupational health + Insurance

(Currently only available in Hungary)

Choose our most complex and comprehensive health improvement, protection and services solution: combine the digital wellness programme with occupational health services and advanced health insurance plans

- Fitpuli application

- Professional attitude test

- Team challenges

- Occupational health services

- Health insurance

| Module | Puli Start | Puli Plus | Puli Care | Puli Pro |

| Medical |  |

|

|

|

| Lifestyle |  |

|

|

|

| Individual challenges |  |

|

|

|

| Team challenges |  |

|

|

|

| Professional attitude test |  |

|

|

|

| Occupational health services |  |

|

|

|

| Health insurance and medical care |  |

|

|

|

| Medical care |  |

|

|

|

| Appointments |  |

|

|

|

What's included?

| Module | Puli Start | Puli Plus | Puli Care | Puli Pro |

| Medical |  |

|

|

|

| Lifestyle |  |

|

|

|

| Individual challenges |  |

|

|

|

| Team challenges |  |

|

|

|

| Professional attitude test |  |

|

|

|

| Occupational health services |  |

|

|

|

| Health insurance and medical care |  |

|

|

|

| Medical care |  |

|

|

|

| Appointments |  |

|

|

|

Stay in the know

Sign up for our newsletter and never miss another update on digital health care, employee wellness programmes and all things health! Powered by Fitpuli’s health experts.

Back to the list

Back to the list